✍️ Tariffs Don’t Bring Jobs Back—or Lower Prices

They tax the wrong people and don’t solve the real problem.

Tariffs are back in the headlines. And once again, we’re hearing promises from Trump that raising tariffs on imports will bring jobs home to the United States and strengthen our economy.

I’m not an economist or a trade expert. But like many people, I care about jobs—and what it really takes to bring them back to the United States.

I’ve been trying to better understand tariffs—what they’re supposed to do, what they actually do, and what they don’t do.

What I’m learning doesn’t match the promises. Tariffs don’t rebuild industries. They don’t fix the deeper problems that led to offshoring jobs in the first place.

Offshore Production Still Dominates

If the goal is to get U.S. companies to bring their factories and jobs back from overseas, simply slapping tariffs on foreign-made goods won’t get us there.

That might sound tough, but in practice, it just raises prices for U.S. consumers and small businesses—without changing the real reasons companies moved those jobs abroad in the first place.

If a company moved overseas to cut labor costs and avoid regulations, a tariff doesn’t suddenly make the U.S. more appealing. It still doesn’t make financial sense, especially for U.S.-based multinational corporations.

If the cost of doing business here is still higher—because of wages, training needs, or infrastructure—that company isn’t likely to return just because of a new tax on its imports.

In fact, many companies just shift production to another low-cost country that isn’t hit with the same tariff. After the Trump tariffs on China a few years ago, some companies—like Apple’s suppliers—moved production to Vietnam or India.

But prices didn’t go down. The jobs didn’t come back. And the costs still landed on U.S. consumers.

Who Really Pays for Tariffs?

That’s what makes tariffs feel like a tax on all of us.

You pay it at the register, whether the thing you’re buying is made in Vietnam, Mexico, or right here in the U.S.

Tariffs don’t punish the corporations that moved jobs overseas. They punish us. They just make everyday goods more expensive—and small businesses less competitive.

And when countries hit back with tariffs of their own, U.S. exporters take another hit. That’s what happened to U.S. farmers during the last trade war. It’s happening again.

The Factory Floor Still Sits Empty

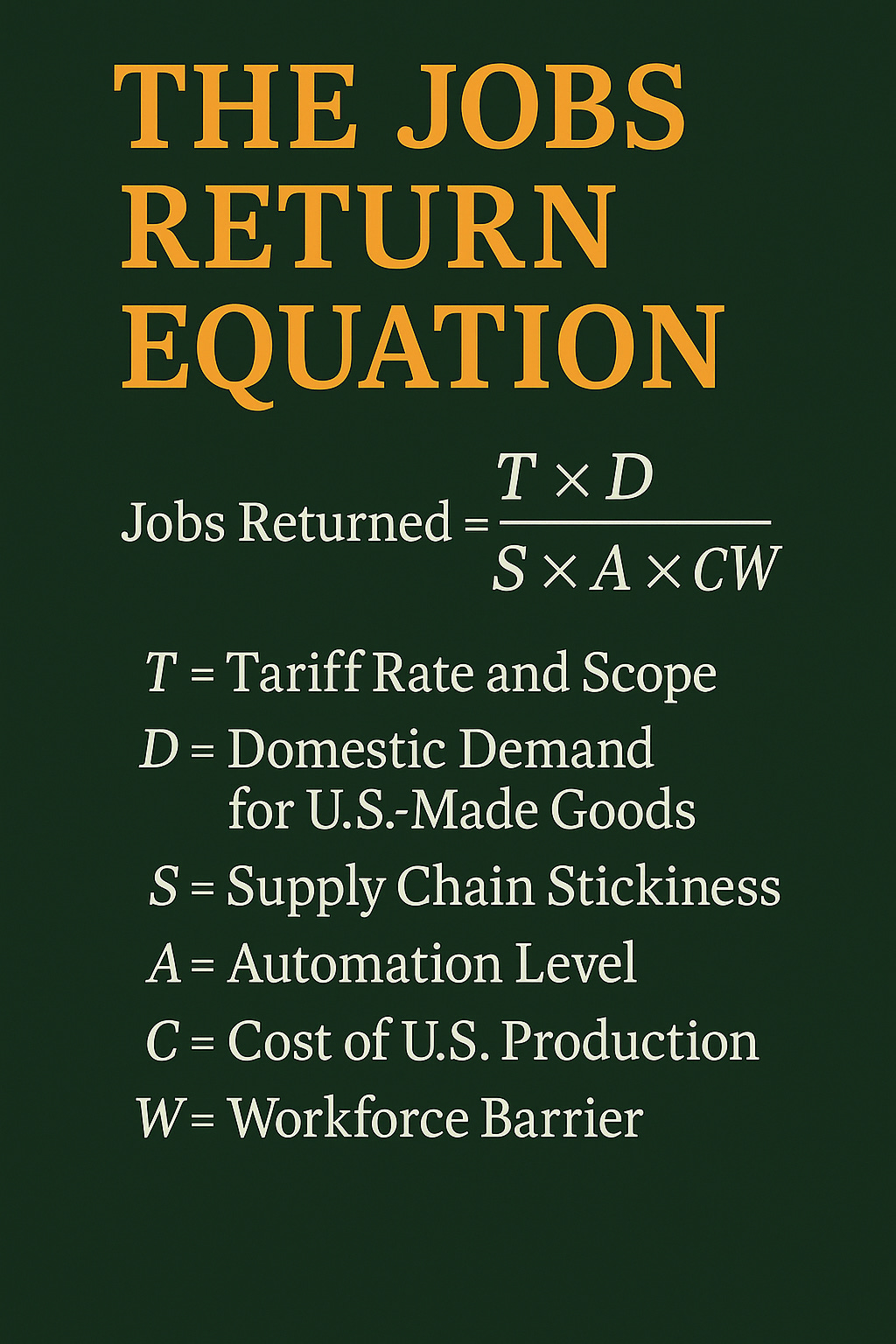

Earlier this year, I tried to break all this down using a simple formula—something to help me make sense of it. It still works:

Jobs Returned ≈ (Tariffs × Domestic Demand) ÷ (Supply Chains × Automation × Costs × Workforce Barriers)

What does that mean in plain terms? Even when tariffs go up, jobs rarely come back—because the same barriers stay in place:

Complex, global supply chains that aren’t easy to shift

Automated production that reduces the need for human labor

Higher domestic costs, from wages to utilities to red tape.

And a lack of trained workers ready to fill new roles

In fact, some companies are already shifting operations further offshore just to avoid the fees.

It’s not just about tariffs. It’s about the whole equation.

And the people who should be feeling pressure—corporations that offshored jobs to boost profits—are often the ones who can afford to game the system.

Ask More Questions. Demand More Answers

I’m frustrated that this same blunt policy keeps getting recycled like it’s new.

I’m concerned that real economic solutions keep getting sidelined in favor of campaign slogans.

I’m not saying tariffs never serve a purpose. Sometimes, they can be a bargaining chip or a short-term tool in trade negotiations.

But as a strategy for bringing back American jobs? We deserve better answers, like:

Why can U.S. companies move jobs overseas with no accountability?

What are we doing to rebuild domestic supply chains?

How are we preparing workers for the jobs we want to bring back?

Who benefits from tariffs—and who pays the price?

We can do more than just slap a fee on imports and hope for the best. Let’s focus on the whole picture—not just the price tag.

💡 What Should We Be Doing Instead?

If we really want to create good jobs here at home, we need to stop passing costs to the wrong people—and start investing where it counts.

We could start with:

Investing in training and education, so workers are ready for the jobs we want to create

Upgrading infrastructure, to support modern manufacturing and resilient supply chains

Supporting industries that pay fair wages and serve the public good, like clean energy, public health, and education tech.

Trump may not be listening. But people around us are.

We can speak up when we hear the “tariffs fix everything” line.

We can ask better questions. Share better ideas.

We can support leaders who understand that real economic growth doesn’t come from slogans. It comes from strategy, investment, and honesty.

Related Resources in Plainly, Garbl

🟧 Tax Reform & Public Investment

A ranked guide to advocacy groups working for a fairer tax system and economic opportunity for all.

A ranked guide to advocacy groups promoting economic security, fair wages, and opportunities for working families.

🟫 Education: Preschool to Public Schools to Higher Ed

A guide to advocacy groups fighting for equitable, well-funded education from early childhood through college.

🟨 Transportation & Transit for All

A ranked guide to advocacy groups improving U.S. transportation systems and public transit access.

🟩 Energy Conservation & Climate-Smart Energy

A ranked guide to organizations supporting renewable energy, decarbonization, and energy justice.

🟩Health Care Access & Public Health

A ranked guide to advocacy groups working to ensure affordable, accessible health care for all.